- 30 Nov 2023

A Guide to IATA ARM (Airline Retailing Maturity) index

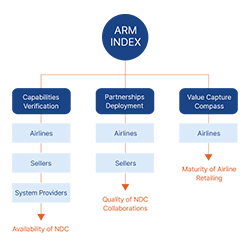

The ARM, or Airline Retailing Maturity Index, was introduced by IATA at the DDRS in 2021. Including airlines, vendors, and system suppliers, its goal is to promote better retailing across the sector. With the program, the airline can assess its current position through IATA, which insists on substantiating retailing skills, additionally fostering transparency. Businesses can, thus, evaluate their capabilities in comparison to other players and identify suitable partnerships with more ease.

What is the ARM index, and why was it built?

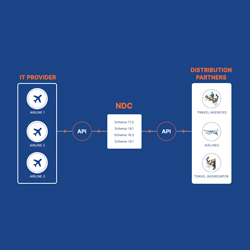

The ARM obtains the industry player’s technical prowess, potential value, and collaborations. A classification of NDC capabilities provided to airlines, merchants, aggregators, and IT suppliers is called a certification.

IATA developed the ARM index to assist carriers and their partners in evaluating the maturity of their transition towards airline retailing. More specifically, each airline gets a roadmap that shows them where they stand as the world moves towards 100% Offers and Orders, as well as the introduction of new advancements they may consider to maximize future benefits.

It helps achieve consistency in implementations by giving the entire industry visibility into every member’s abilities. The ARM index replaces the NDC and ONE Order Certification registries, acting as a distinctive source of information. In other words, IATA uses the data present in the ARM to track industry changes and identify areas of support for the sector.

Reasons for the change

Two main reasons have been cited for this change:

Comparative analysis

The revised certification provides a thorough evaluation of retailing competencies, as the index adds several distinct capabilities that organizations can provide. It builds on four levels against the previous NDC certification.

Smooth certification processes

IATA launched several programs before 2021, such as the well-known NDC, Future of Interline, One Order, Settlement of Orders, and Dynamic Offer Certification. Now, all these have been compressed into a single certification with the ARM index.

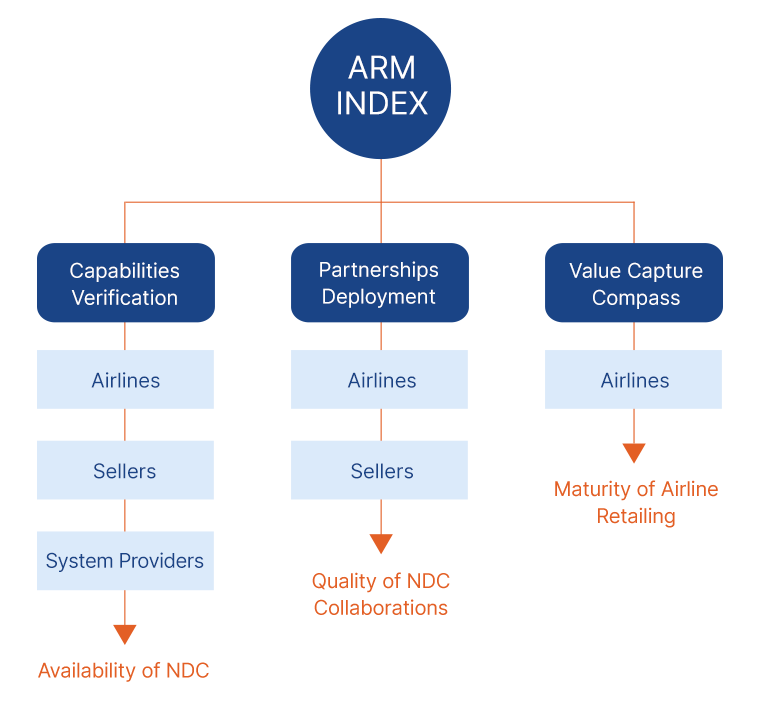

Organizations are assessed across value capture compass, partnerships deployment, and capabilities verification categories.

Capabilities Verification

The ARM evaluates airlines, sellers, and systems providers. While avoiding technical terms, information is described in business language. For instance, the verification process analyzes if a travel vendor processes a booking rather than receiving technical signals related to flight shopping.

It is a registry that collects technical information about whether the providers have abilities favorable to shop, order, pay, settle, account, and set up.

What does the process involve?

Organizations must submit capabilities according to the IATA Enhanced and Simplified Distribution (EASD) standards, which involve at least six categories, including core and variant competencies—ref: infographic for core groups.

In all, IATA has 83 defined capabilities, and in order to validate these, companies can present information in the form of XML messages, screenshots, documents, or a demo of their capability. To fortify their eligibility, organizations must also register the technical messaging, partners utilizing these live abilities, and when they were confirmed.

Partnerships Deployment

This pillar for sellers and airlines evaluates their scalability along the retail value chain. Using IATA’s EASD standards, feedback is collected from partners to understand live capabilities. Additionally, relationship scalabilities are assessed in terms of volume and network reach. The process might involve obtaining confirmation from retailing partners and validating data provided by them.

Four criteria evaluate airlines and sellers.

Capabilities

Verification that the business is operational for specified capabilities and indicated partners

Network Reach

Number of connections and types of partners

NDC Volume

NDC sales and its scalability

Satisfaction Score

Ease of partnerships is measured by obtaining a satisfaction score from partners. Confidentiality is maintained as these scores are shared with the company so that they can work on areas that need improvement.

Value Capture Compass

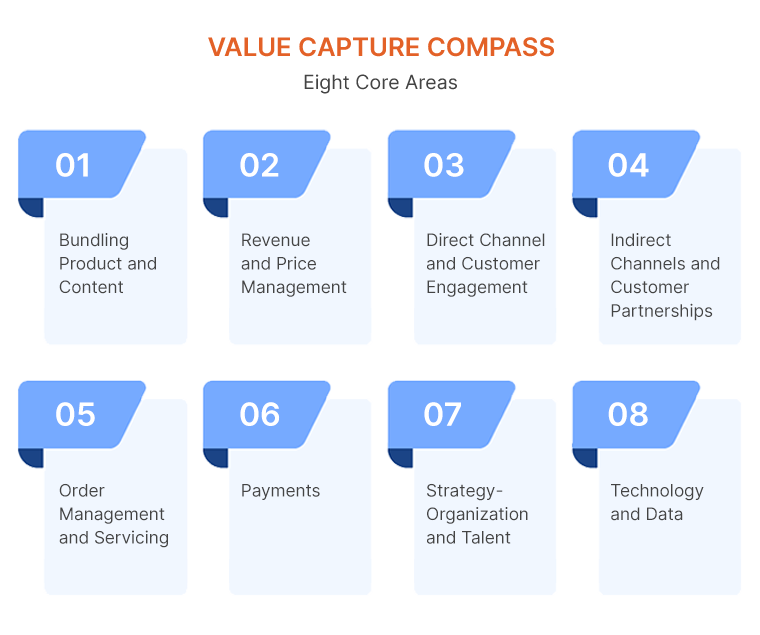

Involving only airlines and no other provider, this pillar assesses how well the carrier has matured in capturing the potential value derived from airline retailing. The scope of the estimation also encompasses all aspects involved in the journey towards 100% Offers and Orders, including direct and indirect sales. An airline can evaluate changes made to policies, organization, procedures, and strategies to become an airline retailer by completing 50 questions in a self-assessment survey that covers a set of value enablers. This way, airlines can check their maturity rates across eight core areas.

Airlines that complete the process successfully get a numbered score out of 100. This represents the maturity of their retail offerings along with their strategy. Additionally, you can also compare airlines with the score. Carriers can identify gaps and prioritize their improvement through consideration points shared by IATA, helping airlines better equip themselves for modern retailing.

The Capabilities Verification pillar is available to the public on the ARM index registry. However, Partnerships Deployment and Value Capture Compass have structured accessibility available only to particular airlines.

Benefits of the ARM Registry

The ARM Registry is the only resource available to the industry for recognizing player abilities. This is made possible by IATA’s EASD regulations, which offer everyone involved a spate of distinctive, industry-valued parameters such as verification of airline retailing abilities and a list of partners they can collaborate with on the implementation.

Based on specific goals, industry groups find information in the registry extremely useful since it provides an objective and unbiased view of the companies’ positions. It is a valuable resource that helps organizations make essential decisions about their partnership development strategy. As the industry rapidly moves towards 100% Offers and Orders retailing, the Airline Retailing Maturity Index registry becomes a vital tool, especially for players enabled by IATA EASD. The consistently growing ARM offers everyone on the journey a unique perspective of the industry's maturity from both technical and value creation standpoints. It plays a crucial role as the sector moves towards true modern Airline Retailing.

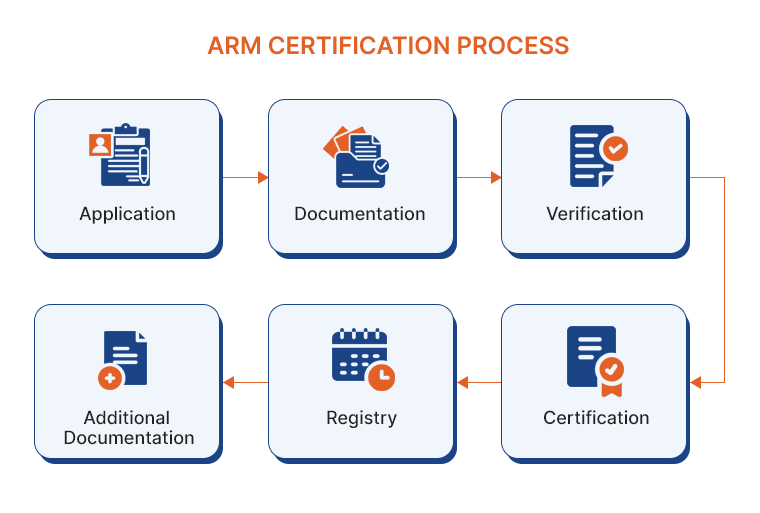

Certification Process

Companies have to approach the IATA ARM portal to obtain the relevant application form, complete it, and sign it along with a fee. Currently, the charge applies only to service providers, and airlines or sellers are excluded from the surcharge.

After that, your application is reviewed by IATA, after which secure platform access is provided to collect additional information.

The ARM index certificate is granted once the reviewing body is satisfied with the data provided by the applicant. Subsequently, IATA adds the company to the ARM index registry.

All suppliers must provide periodic verification processes to update the certification for Capabilities Verification, Partnerships Deployment, and Value Capture Compass, where applicable.

Maturity Report

The ARM index Maturity Report is sent to airlines in confidence after they complete all the pillars assigned in the index. A score is derived based on the data provided. The report also includes feedback from IATA, partners’ responses, and benchmarking against peer groups (where the company stands among similar players) and industry leaders based on the data provided. Airlines, thus, with the help of the report, can assess their current positions, pinpoint their progress toward becoming an airline retailer, and develop plans along the way to add future value to their journeys.

What it means for travel service providers

In the end, the ARM gives more context and visibility for the capabilities while providing information about their operability. Earlier certification levels did not demonstrate competence. Instead, it would be bestowed on a broad group of capabilities without transparency. The ARM index provides more perceptibility because it displays specifics of offerings, and IATA’s EASD standards break them down according to airlines and suppliers. Features description and implementation guidelines are also part of the index. Now, travel sellers can select the attributes crucial to their company and explore airlines that provide them with more value, thus enhancing customer experiences simultaneously.

Recent Post

-

Sustainability in Travel : How travel technology drives eco-conscious tourism

25 Apr 2024

-

The Collective Power of NDC for Airlines, Agents, and Customers and its benefits in the travel chain

11 Apr 2024

-

Streamlining Travel Experiences: The Importance of Integrating Airport Transfers into Booking Systems

27 Mar 2024

-

Hotel API Integration: Why it’s important for travel businesses

18 Mar 2024

-

Automate the itinerary building process 5 reasons why travel agents need a travel itinerary tool

27 Feb 2024

-

What is travel technology? An overview and its role in the travel / tourism industry

12 Feb 2024

-

Why Every Travel Agent needs an Online Booking System in the Modern Digital Age

18 Jan 2024

-

The Role of Analytics in the Travel Industry

08 Jan 2024

-

How ChatGPT can improve the Travel and Tourism sector with it’s AI capabilities

26 Dec 2023

-

AI-powered Journeys: How AI is Reshaping the Travel Landscape this Holiday Season

22 Dec 2023

-

The Crucial Role of an Automated Mid-Back Office Solution for Streamlining Travel Operations

11 Dec 2023

-

A Guide to IATA ARM (Airline Retailing Maturity) index

30 Nov 2023

-

A Guide to Corporate Travel Management

16 Nov 2023

-

The Role of NFC in the Travel Industry

02 Nov 2023

-

World Tourism Day 2023: Unveiling the Future of Travel Technology

27 Sep 2023

-

How is AI emerging in the travel industry?

21 Sep 2023

-

Pratra’s Innovative Travel Technology Products

04 SEP 2023

-

The Rise of Robots in Travel Industry and its Role in Enhancing Customer Experience

13 AUG 2023

-

Difference between Conventional APIs and NDC APIs

01 AUG 2023

-

What is Travel API, and how can it help your business?

03 JUL 2023

-

Using AI to Empower Travel Advisors

05 Jun 2023

-

Top 5 Benefits of AR/VR Technology in the Travel and Tourism Industry

17 May 2023

-

Facial Recognition Technology and Contactless Check-ins in Modern Airports

05 Apr 2023

Let’s connect!

Our expertise is here at your disposal. We can’t wait to make use of it and help you succeed.